Issue

The service charge for appointments already paid for by a client has changed.

The new service charge amount is less so the client is now in credit for all appointments already paid for.

How do I make use of this credit in future payments?

Solution

The best way is to convert the total credit amount into an overpayment.

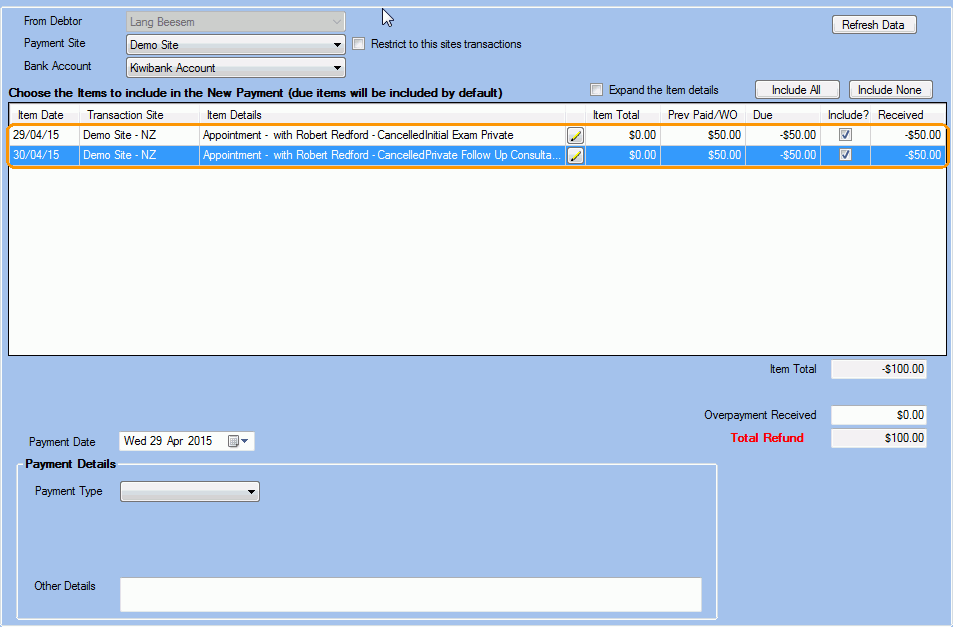

The image below shows a credit of $50.00 (Received column) for 2 appointments already paid for (Prev Paid/WO column).

- Ensure only the items in credit are included (Include? checkbox is ticked). The Total Refund field should display the overpayment amount to be created.

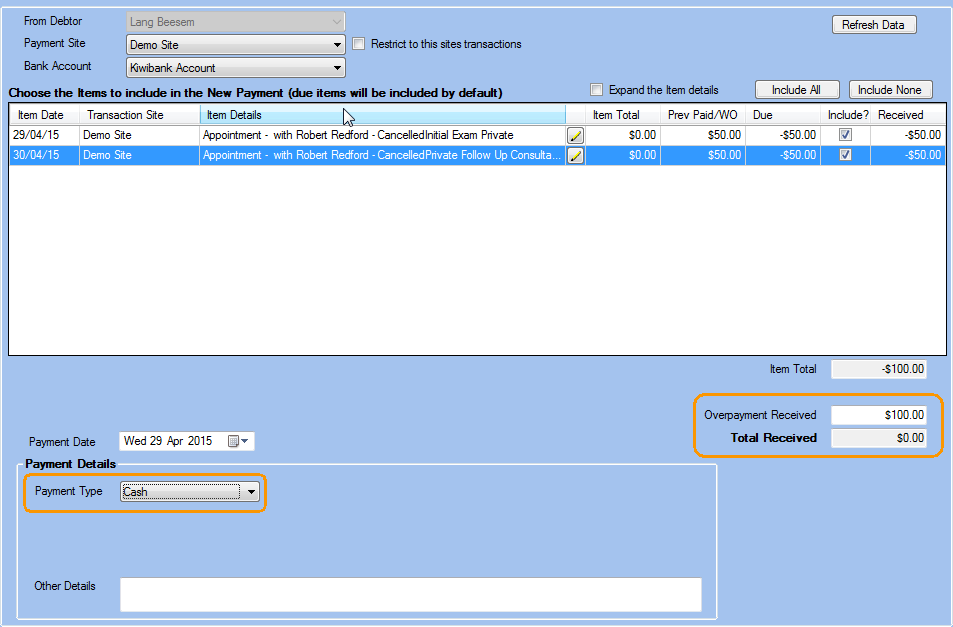

- Enter the overpayment amount in the Overpayment Received field. In this example, create an overpayment of $100.00 .

- The Total Received field will change to $0.00 as it is an Overpayment.

- Set the Payment Type to Cash or Direct.

- Click Save.

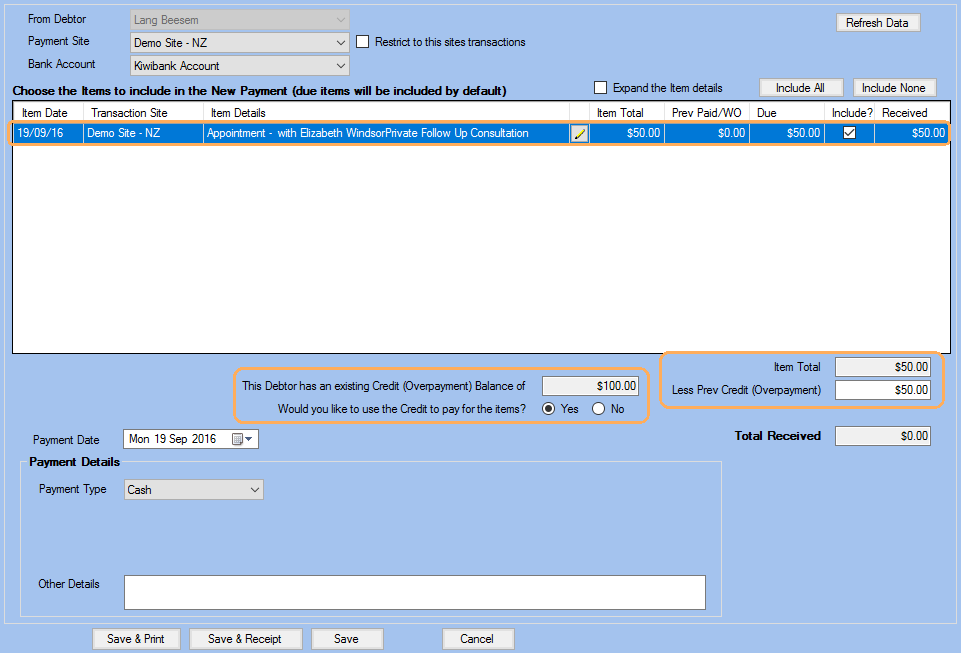

- When you open the New Payment form again, the option to use the overpayment will be displayed for future payments.

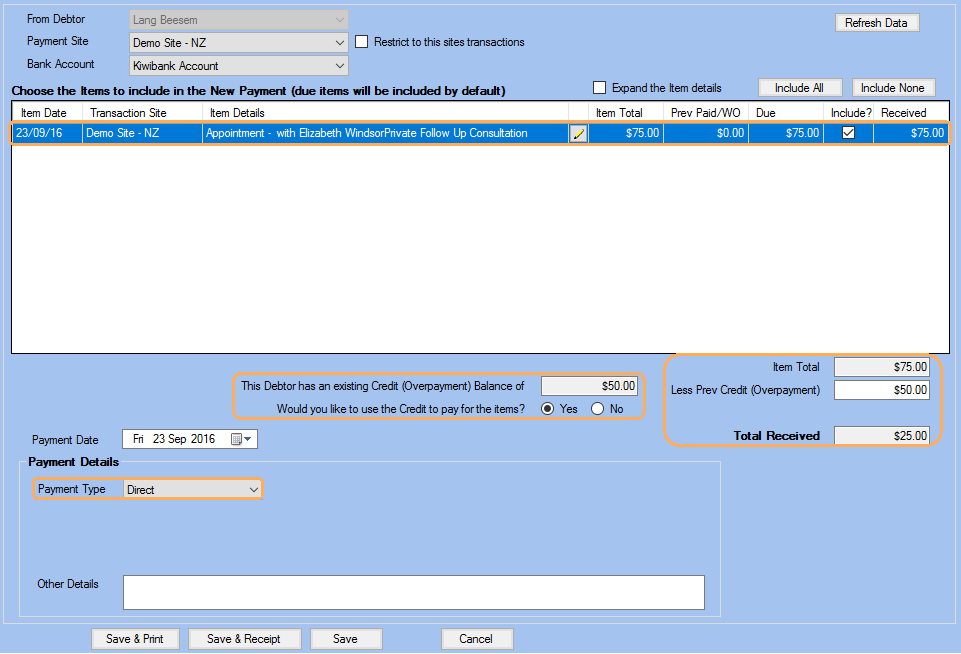

Note: In the example below we will use a $100 overpayment to pay an appointment item of $50, and on later date use the $50 remaining in overpayment to pay for another appointment item of $75, leaving a balance of $25 for the client to pay.